Winning Existing Customer Business Requires an Intentional Digital Strategy

The recent $1.1 billion Mega Millions lottery drawing brought to mind for me the old Arizona Lottery ad campaign that made the very true statement of “you can’t win if you don’t play.” Yes, you may not win, and therefore have spent money that could have bought a candy bar, but there is zero percent chance of winning the lottery buying a candy bar.

While digital marketing should be conducted with more strategy than a lottery ticket purchase, it is surprising how many financial institutions don’t “play” in the digital marketing arena with any seriousness. This reluctance is the most likely reason incumbent brands lose so many opportunities for new business with existing customers.

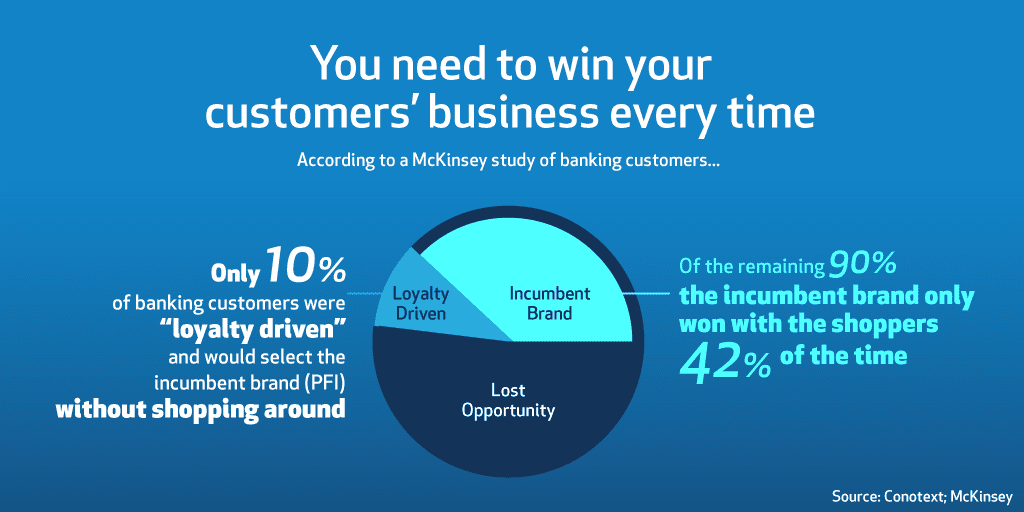

A study by McKinsey & Co. of banking customers found that only 10% of in-market consumers “purchased” from their primary financial institution (PFI) without shopping around. Of the remaining 90%, only 42% ended up choosing their PFI after shopping around. That means incumbent brands are winning less than half of the battle for business with their existing customers!

The key to winning more business from existing customers requires both strong brand awareness and reminding them of your relevance at the right time.

Digital-First Marketing Strategy to the Rescue

The modern consumer perspective boils down to this: they want a solution to a problem as quickly and easily as possible, not to mention at the lowest cost possible given other factors (see first criteria).

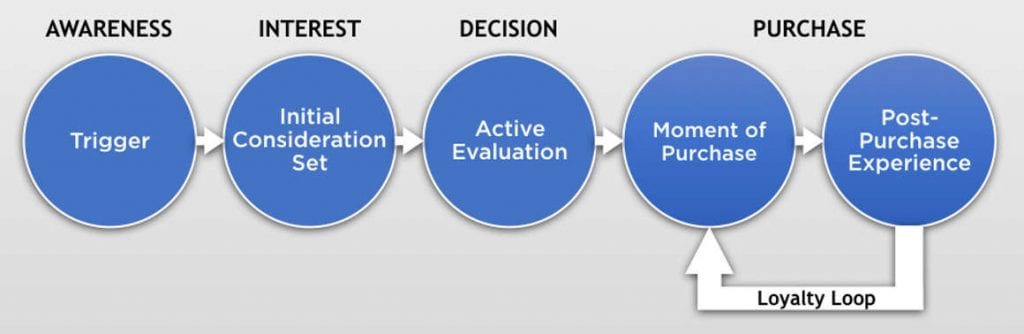

The digital consumer journey jumps from Awareness (and research) of the problem and possible solutions, to Interest (and research) into possible solution providers. From there the consumer must make a Decision as to the best solution provider and Purchase the solution from that provider. This process can take as little as a few minutes to many weeks depending on the complexity of the problem and the level of comfort the consumer has with the decision to be made.

This is where most banking brands fail, you are only working on one phase of the consumer journey…awareness. Your customers need to not only know you provide for them currently (awareness) but have a relevant solution for their current need (interest and decision).

Marketing efforts that successfully addresses the consumer’s needs in each of the four phases of the journey can be applied to every marketing channel, not just digital. However, digital has become the most critical channel to compete in.

If you would like to get started building a digital-first marketing strategy right away, contact us to discuss our strategic philosophy and your specific marketing challenges.