As I discussed in the last post, building a digital-first marketing strategy requires the marketer to understand the consumer journey for EACH persona and for EACH product or service they offer. Too many banking consumer surveys focus on channel usage in generic ways, measuring things like device preference and importance of branch convenience.

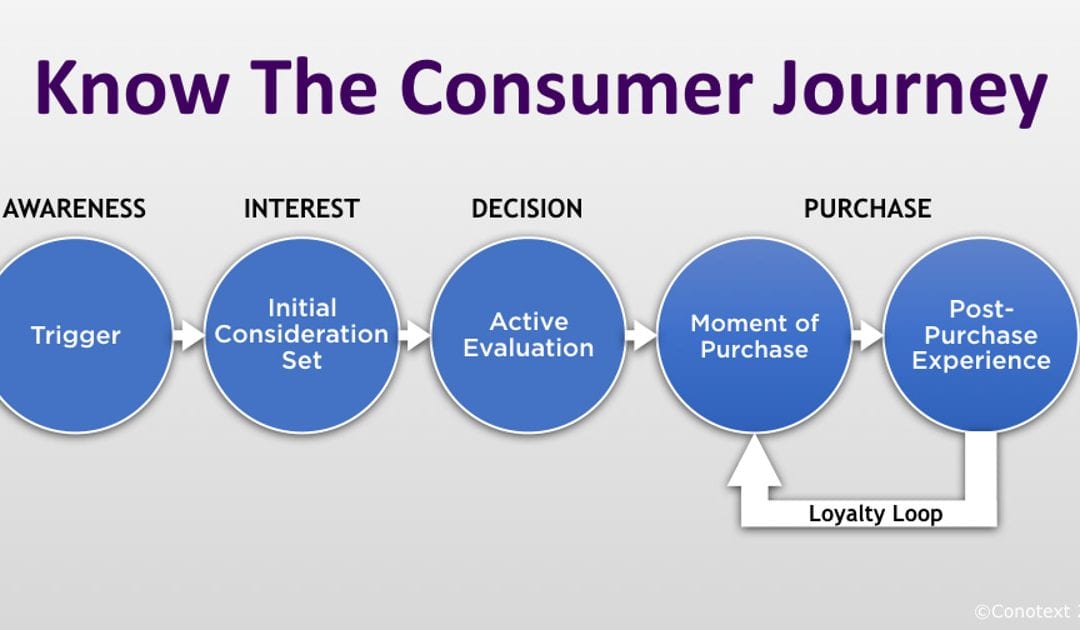

It is not enough to have a general idea of how someone shops for financial products and services anymore. Effective digital marketing requires understanding how different a 30-year-old couple shops for a home compared to 40-year-old parents with two kids. The challenge then becomes a matter of breaking down the consumer journey in a meaningful way while keeping the number of target segments manageable. The good news is that while we can get really complicated with our breakdown, a simple four-phase journey — Awareness, Interest, Decision and Purchase — serves the purpose very well.

Awareness of a Problem or Need

Brand awareness is critical during this phase of the journey as consumers research their problem and possible solutions. A 2016 Synchrony Financial study showed that 85% of major purchases start with online research, up from 80% in 2015. Before you can be included in the initial consideration set during the Interest phase you need to be known for having related solutions through direct experience or exposure to your brand. That exposure could occur online or in traditional channels. Having content that speaks to a specific need and helps the searcher identify a proven solution during the awareness phase can also help your brand be part of the initial consideration set.

Interest in a Solution (Provider)

People just want to solve their problems and solution providers are often viewed as a necessary evil to getting that job accomplished. If you are part of the initial consideration set, you must show that you have the right answer to their problem. This is no time to talk about yourself. This is the stage where you must show them that you understand their problem and have successfully solved similar problems for people like them before. This is where it is critical to speak to a person with a specific need, rather than a generic consumer of financial products. Highlighting a story about a customer that had the same need as the target audience is a great way to connect during this stage.

Making a Decision

Shoppers are making decisions faster than ever, with the Synchrony Financial study showing the time spent researching major purchases dropped from 65 days in 2015 to 63 in 2016. Winning in this phase requires showing that your solution is the best fit, has the best price/value and has as easy a fulfillment process as (if not easier than) the other options they are considering. Digital channels need to be able to show this through clear product information (specifications), purchase process descriptions, and customer testimonials or reviews. If you think about it, this is the same information a good salesperson would use to convince a shopper to buy from them rather than visiting another store.

Building Loyalty with the Purchase and Post-Purchase Experience

In the banking industry, 56% of consumers say they have — at some point — become frustrated enough with an online application to just give up. That’s according to a study by Signicat. Peter Wannemacher, Senior Analyst at Forrester, claims abandon rates for online banking applications are at an all-time high of 97.5%. A smooth purchase experience can provide a huge lift in conversion rates and begin building crucial customer loyalty from the beginning. If you can’t make the digital experience smooth enough (you do know your abandonment rate, right?), you should consider ways to quickly move consumers over to phone or branch to complete the purchase there.

Build Your Marketing Strategy on Your Unique Qualities

The best ways to connect with your target audience in each of these phases is to speak to their need at that stage of their journey with what makes you different from all of the other brands competing for their attention. Especially in the Awareness and Interest phase you need to show your expertise solving the problems they are trying to solve while in the Decision and Purchase phase you need to speak to costs in terms of time and actual dollars. This may be the most difficult part of the process as it requires a reframing of product and service messages from being focused on features (all about you) to being focused on how well it solves a problem (all about their need). This is often where it is helpful to have an outside partner help break old product marketing habits.

If you would like to get started building a digital-first marketing strategy with a trusted partner with decades of experience marketing financial services, contact Conotext to discuss our strategic philosophy and your specific marketing challenges.