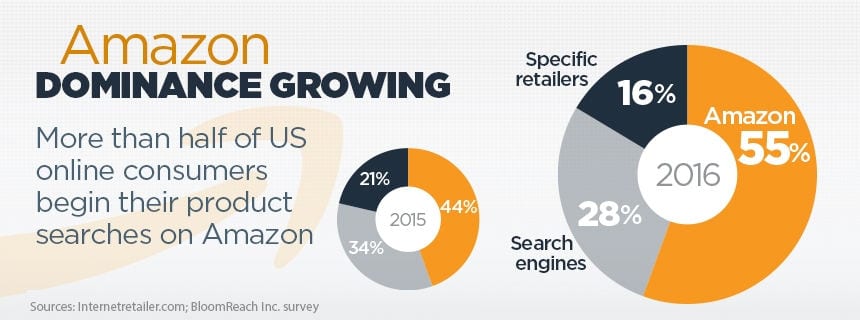

Dominance in the search channel has been a major key to Amazon’s success. Amazon’s reach has grown so much that it has changed the shopping habits of an increasing number of consumers. A recent survey by BloomReach, Inc. found that the number of consumers who begin their online search for a product with Amazon increased from 44% to 55% between 2015 and 2016.

Dominating the Search World

Amazon is reaping the rewards of its strategy to dominate the organic search results on major search engines both through paid and organic results. Now more than half of digital consumers have gotten so used to having what they look for online being available at Amazon that they just go to Amazon by default.

Why is this relevant to banks and credit unions? It is relevant because it points to something we talk about at Conotext every day. When given the option, consumers will take the path of least resistance. The lesson for banks and credit unions is you need to look at how to reduce the friction in the consumer journeys related to the products and services you offer.

Do You Know Your Customer’s Journey?

This journey starts when a potential customer has an idea or realizes they have a need that needs to be met. Do you know how those journey’s begin? Do you know what those consumers search for as they move from idea/need, to learning about possible solutions, to deciding on a solution, to buying the solution?

Amazon certainly understands the journey for every one of their diverse array of product categories. How much time has your organization spent on studying the online habits of the modern consumer? If the answer is “none,” don’t worry…most of your competitors have not spent any time on it either.

If you want a true competitive advantage in the new economy, why not start at the beginning of the journey of a potential mortgage customer, or auto loan customer, etc. You may be surprised at what you discover. If you would like a guide for that research, let us know.